The Workplace Charging Scheme (WCS)

Don’t miss your chance!

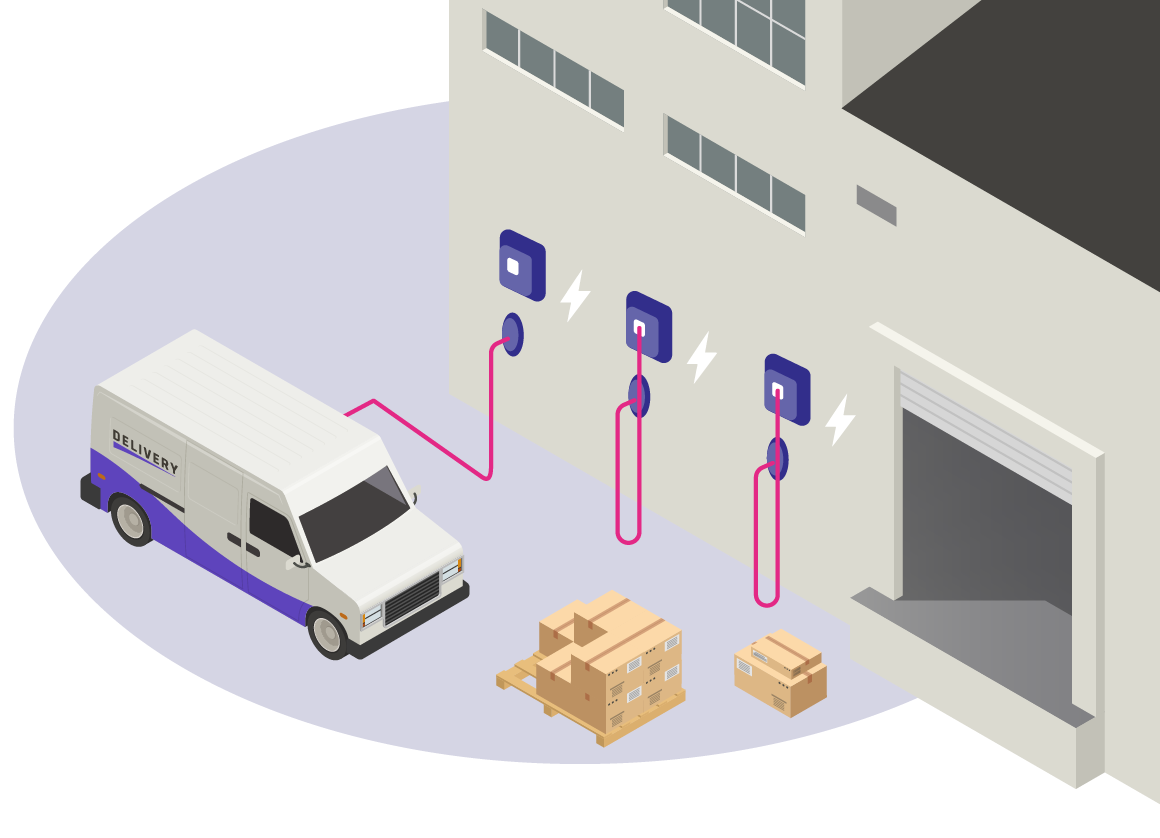

With the mass adoption of electric vehicles, what better time to future proof your business?

More and more UK businesses are realising the significance of offering electric vehicle charging facilities for staff, customers and visitors alike.

With targets in place for all new cars and vans to be zero emission by 2040, offering EV charging at your premises can no longer be ignored.

Receive a grant for £14,000 for charging points at your business!

The WCS is a voucher-based scheme that hugely reduces the purchase and installation cost of electric vehicle charge-points by up to 75% (capped at £350 per socket). Businesses can claim for a maximum of 40 charging stations (40 single sockets or 20 double sockets) under the scheme, which is managed by the Office for Low Emission Vehicles (OLEV). This can equate to a cost saving of up to £14,000.

Firstly, you need to complete an online application form.

Once successful, you will be issued a unique voucher code within 5 working days. The voucher is valid for 120 days from the time of issue. The installation must take place within this time.

Redeem your voucher. A voucher can only be redeemed by an OLEV authorised installer. The installer will check the application and make the claim for the grant on your behalf. The installation will commence once verified.

OLEV will action the grant payment to the installer within 30 days. Your installer will claim the value of the voucher on your behalf. This grant value will then be deducted from your invoice.

How does the WCS work?

The WCS was established in 2016. It has been stressed by The Office for Low Emission Vehicles (OLEV) that these grants will only be available to the early adopters. From its starting level of £1000, the WCS grant has already shrunk noticeably, and has now decreased to £350 per socket (since 2020).

For how long is the Workplace Charging Scheme available for businesses?

The WCS is available to any business, charity or public sector organisations.

It is a requirement to have sufficient off-street parking, and the parking facilities must be clearly associated with your premises. You will need to either hold ownership over the property, or to have consent from the landlord(s) for the installation(s) stated in your application.

Whilst you do not need to currently have electric vehicles as part of your fleet, you can clearly demonstrate the current need for charge points (or in the future) to the benefit of your staff, or company fleets, & not necessarily for customer use.

Charging stations must be installed by an OLEV registered installer.

Does my business qualify?

What are the benefits of electric car charging stations for businesses?

Government funding – Take advantage of grants and incentives to reduce the costs of installation, and overall purchase.

Cost savings – Significant financial savings on fuel costs for company cars, and fleets - managed by a central charging solution.

Control of electricity billing – A bespoke back-end charging system is implemented allowing you to control, analyse and manage usage.

Employee benefits – Considered to be a useful tool to retain and attract staff, as their vehicles can charge whilst at work.

Employee tax advantages - Reduce staff ‘benefit in kind’ tax for company cars.

Value added service to client visits – Premium service to those who drive an EV.

Future-proof – Equipped to accommodate the exponential uptake of EV usage.

Corporate social responsibility – A visible approach for organisations to demonstrate their commitment to sustainability, and reduce CO2emissions.

Enhance brand image - Establish your business as ‘a green’ advocate, and pioneer of the EV revolution.

Marketing of building premises - Become more attractive to both potential, and existing tenants.